However, due to income restrictions to maintain eligibility for SSDI benefits, you may not meet income requirements for some mortgage lenders. If you receive Social Security Disability benefits (SSDI), there is no asset limit, so your eligibility to continue receiving benefits would not be in jeopardy. This may include needing to sell other properties that you may own, but do not live on. So, in general, purchasing a home with Social Security is not an issue, as long as you do not obtain enough assets or property to limit your ability to remain eligible. Money set aside in a Plan to Achieve Self-Support (PASS) plan. Property used by you or your spouse for your job or business.

Individual burial funds for you and a spouse that do not exceed $1,500. Life insurance policies with a combined face value of $1,500 or less. Items that do not count towards the cap - or resource limit - include: The cap is $2,000 for an individual and $3,000 for a couple. SSI beneficiaries have a cap on the assets they own to continue to receive SSI. However, there are a few things to consider. Receiving Social Security Income (SSI) and Social Security Disability (SSDI) do not prohibit you from purchasing a home. This guide will offer resources for finances and information that you will need to know and may use in the process of purchasing a home. Purchasing a new construction home may also be a great option, as they may have more open and desirable floor plans that have been designed with accessibility in mind, or you may be able to ask for changes to the floor plan and features before the construction is completed. Or, you may choose to break ground with new construction for the ability to customize a home to meet your personal needs.

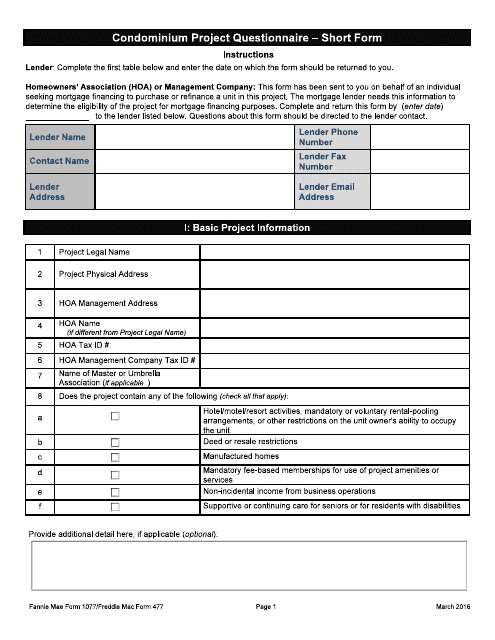

Fannie mae and freddie mac help for people with disabilities professional#

You may choose to work with a professional real estate service to purchase a home that is already built, and you will need to prepare to make any necessary modifications for accessibility. While considering the accessibility of a home, you have a few choices. You will also need to consider other aspects of the home, which may include the physical layout and accessibility - or whether the home can be renovated to incorporate necessary accommodations. Additionally, you will need to consider the importance of the location of the home in proximity to certain amenities and services you may regularly utilize, such as public transportation or local pharmacies. This may include considering how your new home will meet your personal needs. If you are an individual with disabilities there may be additional considerations you need to make, on top of all the usual things to look for when home shopping. You may consider using a mortgage calculator to consider how your monthly mortgage payments will fit into your budget. If you are a first-time homebuyer, you may look into additional resources and programs specifically for first-time home buyers. Purchasing a home is a life-changing event that can be stressful - particularly if you must get a home that provides specific accommodations for a disability.

Resource Guide for Homebuyers With Disabilities

0 kommentar(er)

0 kommentar(er)